DeepSeek, revisited

Geopolitics of AI

Published: November 28, 2025

On 20 January 2025, the Chinese startup DeepSeek launched R1, a reasoning AI that was as good as the best available models at the time.

DeepSeek became the most downloaded app in the world the same month.

R1 was priced around 20 times cheaper than OpenAI’s o1, and DeepSeek claimed that the cost of training the chatbot was much lower too.

It is not known how much it cost to develop DeepSeek, and the quoted lower costs only describe the final training of the model.

The shares of US tech companies fell after the launch of DeepSeek created uncertainty in the AI sector and beyond.

Nvidia, the designer of computing microchips and the world’s largest company, lost around 20% of its stock value, but recovered after a month.

(More in Section 2)

DeepSeek openly published its model’s parameters and technical innovations, allowing others to benefit from them.

This helped some Chinese AI companies, like Baidu and Z, to catch up with US competitors.

In response to competition from DeepSeek, Google and OpenAI introduced lower pricing tiers and cheaper models.

Other companies, like Microsoft and Perplexity, incorporated DeepSeek models into their products.

DeepSeek has increased its prices and removed some discounts, but is still multiple times cheaper to use than major US models.

Government workers are banned from using DeepSeek in Australia, India, Italy, South Korea, Taiwan and the US.

Businesses in China are required to cooperate with the government and the military, including by sharing data.

US-China Trade War and Nvidia

Nvidia’s chips are the best available on the market currently.

Since 2022, the US has restricted the sale of advanced chips for AI training to China (such as Nvidia’s Blackwell chips and H100).

Nvidia has designed chips specifically for China that maximise power while following export restrictions.

DeepSeek’s founder bought 10,000 advanced H100 chips in 2021, before export restrictions.

After the trade war between China and the US escalated in 2025, Nvidia’s share price began falling again.

Policy shift: in July 2025, the Trump administration decided to change its approach and allow the sale of some chips and software to China as part of a deal.

Tech dependency: the US wants Chinese businesses to keep using Nvidia’s chips and other US technology, for money and influence.

Nvidia’s share price reached a record high by October 2025, while tech stocks in general face some concern of being over-priced.

The US has so far chosen not to create strict legal regulation of AI companies to support their growth.

The EU has chosen to regulate AI more strictly but is now making an effort to simplify the rules and make them more business-friendly.

The UK’s policy has been closer to the US on AI regulation.

China’s policy on AI prioritises:

Independence in major technologies

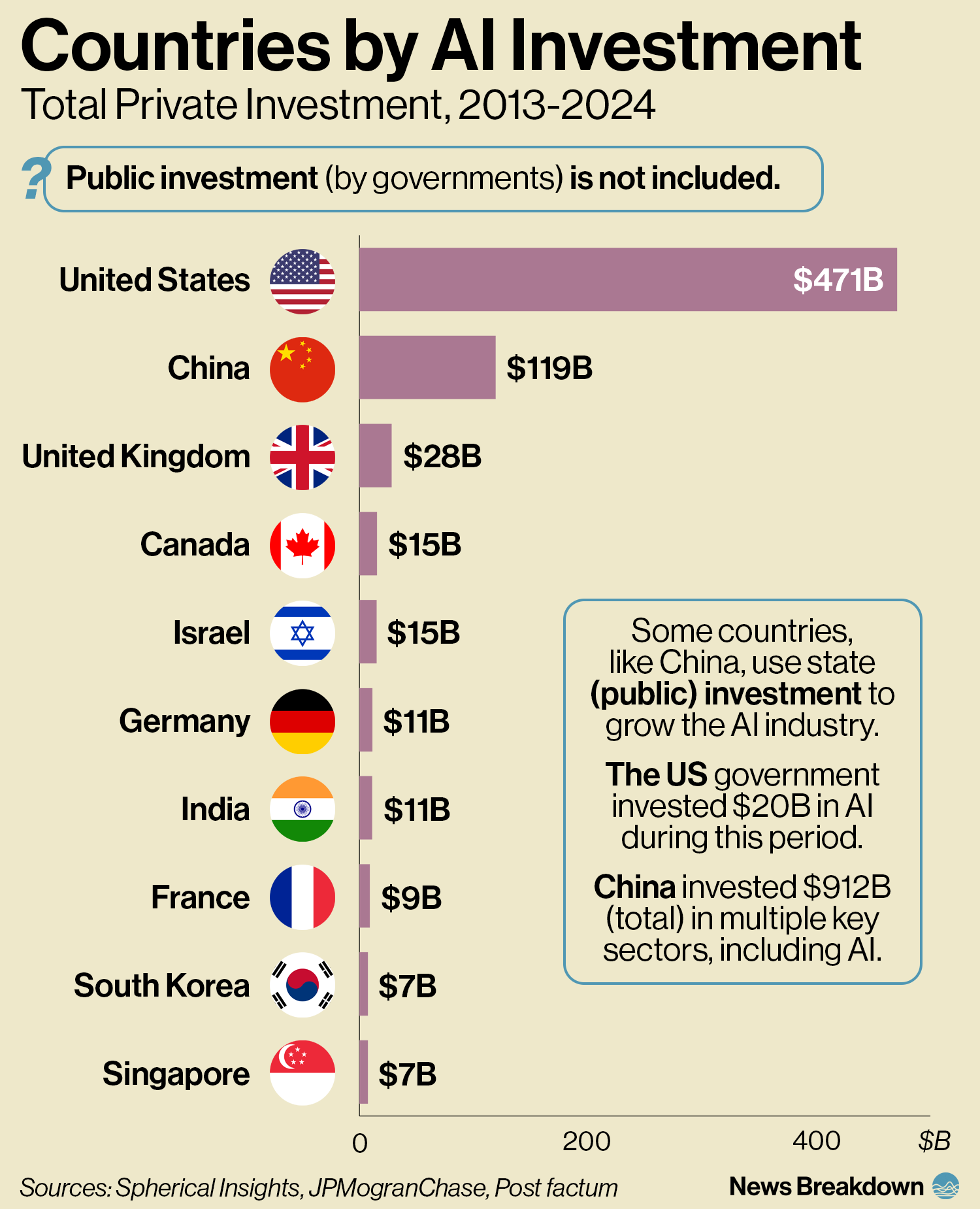

State funding of private companies

Open-source and widely-used AI

World-class energy infrastructure

Multiple countries from the Middle East, such as Saudi Arabia and the UAE, have become major investors in AI companies globally.

Energy demand: enough infrastructure and energy resources are needed to support an AI industry within a country.

Military advantage: AI is increasingly used in war (for example, to guide weapons and process data). Access to better AI is now a matter of national security and geopolitical influence.

Thank you for reading!

Author Anton Kutuzov