Ukraine’s Strikes on Russia’s Oil Refining

Effects, Strategy and Weapons

Published: December 4, 2025

Ukraine has been attacking Russia’s oil refining infrastructure with drones and missiles regularly since 2024.

Oil refining is the process of creating fuel and other products from crude oil.

Since August 2025, Ukraine has intensified these attacks, with over 10 strikes per month.

Main goal: to reduce Russia’s ability to finance its war on Ukraine.

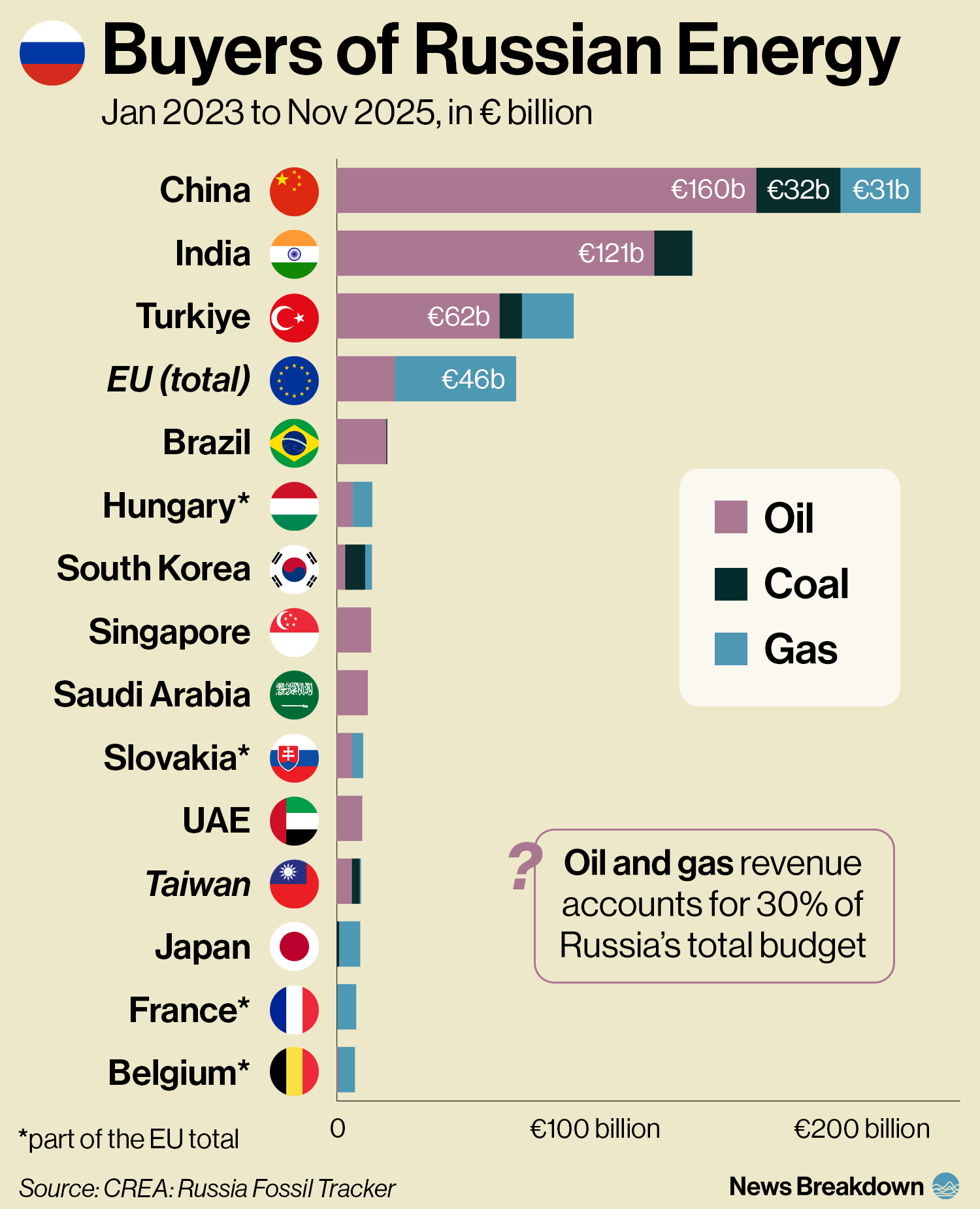

The oil and gas sector accounts for 30% of Russia’s budget.

In 2024, Russia sold oil and gas worth $235 billion, or 63% of its total exports.

Despite the sanctions, Russia’s oil export revenues fell by only 4% from 2021 to 2024.

China, India, and Turkey are the largest buyers of Russian fossil fuels.

How Ukraine conducts the strikes?

So far in 2025, Ukraine has hit 17 major refineries in Russia (out of a total of 30), as well as pipelines and other facilities.

Between August and September 2025, 23 out of 30 attacks on Russia’s energy infrastructure were successful.

Ukraine has developed the ability to strike up to 2,000 km inside Russia.

Ukraine uses medium- and long-range drones produced locally.

It also uses missiles developed by Ukrainian companies, as well as Western-supplied missiles.

Ukraine produces around 4 million drones per year.

These include cheaper decoy drones and FPVs, and more sophisticated long-range drones.

Ukraine is boosting the domestic production of drones and missiles.

On November 28, 2025, Ukrainian drones hit two Russian oil tankers in the Black Sea:

The tankers were part of the shadow fleet: a collection of unregistered cargo ships associated with Russia and transporting its energy exports.

Impact on Russia’s oil refining

Russian oil refineries experienced multiple episodes of shutdowns and reduced operations due to Ukrainian drone strikes.

In August 2025, Ukraine's strikes cut 17% of Russia’s refining capacity, or 1.2 million bpd (barrels per day).

Between August and October, several attacks and planned maintenance cut 20% of Russia’s refining capacity.

Russia’s overall refining output fell by 5%, to 5.1 million bpd, compared to 2024.

Compared to 2021, this is a 9% decrease.

How did Russia offset the damage?

Russia has a potential refining capacity of 6.6 million bpd, which is the maximum output of all refineries if they operate at full capacity.

Russia does not run its refineries at full capacity, leaving over 1 million bpd of spare capacity.

This spare capacity allows Russia to:

Shut down any damaged units.

Send oil to “resting” (idle) units.

Re-activate the idle units.

This explains how Russia managed to keep its refining output at around 5 million bpd despite the strikes.

However, this is a long-term risk:

Spare capacity is limited.

Repairs cost more without access to Western-made equipment.

In November 2025, an attack stopped the work of Russia’s main Black Sea export hub, accounting for 2% of the global oil supply

The strikes on oil refineries have created fuel shortages in Russia.

In September 2025, Russia’s fuel market had a deficit of 400,000 tonnes of fuel, or 20% of national demand.

As a result, about 1 in every 50 fuel stations has stopped selling, and overall production has fallen by around 10%.

Since January, fuel prices have risen by over 10%.

On the annexed Crimean Peninsula, local authorities have imposed limits of 30 litres of fuel per person.

Thank you for reading!

Author Simone Chiusa

Editor Anton Kutuzov