Geopolitics of

lithium

In the last decade, demand and supply grew exponentially, but the rush may just be beginning.

Climate pledges already made would require many times more lithium than is currently traded, and even more so in the Net-Zero scenario.

It is a critical mineral – to nation-states and news-readers.

For the busiest:

Australia, Chile and China account for around 90% of extracted lithium globally.

Over 60% of lithium processing happens at industrial facilities in China.

In 2022, 79% of all lithium-ion batteries were manufactured in China.

Lithium-ion batteries are currently the best available solution for energy storage, so demand for lithium increased dramatically with growing need for storing electricity.

The price of lithium carbonate steadily grew to around $20,000 per tonne until late 2021, when it shot up to $35,000 within months and in 2022 breached $70,000 per tonne.

In 2023, lithium prices dropped by as much as 80% throughout the year.

In many countries, lithium mining turned into a legal and political battleground with fierce fighting for influence over major producing companies and infrastructure, as more nations step in to closely monitor foreign investment deals.

Some companies are experimenting with alternative battery designs, which could potentially be cheap, sustainable and use less critical minerals, such as sodium-ion batteries.

The recent drop in the price of lithium was largely a result of an oversupply and may not be indicative of the future price trend, as the demand for batteries continues to expand.

Resources and further reading are at the bottom of the text.

How is lithium produced?

Due to its highly reactive properties, lithium doesn't appear as a pure metal in nature and could be extracted in two major ways.

Around 60% of lithium is derived from underground brines with a high content of lithium chloride.

This saline-rich groundwater is pumped out into open-air ponds where it evaporates for 10 to 24 months, raising the concentration of lithium for processing into lithium carbonate (Li2CO3) or lithium hydroxide monohydrate (LiOH).

The remainder of the world’s lithium supply comes from hard rock ores.

Following blast extraction in open-pit mining, the crushed ore is then chemically treated and shipped for processing into lithium carbonate or lithium hydroxide.

Brine extraction is the cheapest source of lithium, while some minerals are cheaper to extract lithium from than others.

Australia, Chile and China account for around 90% of extracted lithium globally.

The remainder is supplied mostly by Argentina, Brazil, Portugal, Zimbabwe and the US.

In Chile, Argentina and Brazil, lithium is mostly extracted from brines, while Australian and Chinese lithium is mined from hard rock ores.

Global supply chain of lithium

In 2024, the world’s known lithium reserves amounted to approximately 105 million tonnes.

Approximately 50% of those are concentrated in the so-called Lithium Triangle of Bolivia, Chile and Argentina.

Noticeably, while Bolivia possesses world’s largest known lithium reserves, their development was hindered by political instability, poor economic management and lack of infrastructure, as well as local resistance to proposed projects.

In order to be used in the production of lithium-ion batteries, the lithium derived from brines and concentrated ore must be processed.

Over 60% of this lithium processing happens at industrial facilities in China.

Chile, however, also possesses significant lithium refining capacity with over 25% of global volume, with Argentina accounting for most of the remaining 15%.

Lithium carbonate and lithium hydroxide are then used in the production of battery cells and components.

In 2022, 79% of all lithium-ion batteries were manufactured in China.

The remaining supply came mostly from the US, Poland, Hungary, Japan and South Korea.

The biggest driver of lithium-ion battery production is the growing global demand for electric vehicles, about 50% of which are currently manufactured in China.

What drives demand for lithium?

Even though researchers were already working on lithium batteries in the 1970s, those initial products were prone to bursting into flames and were not rechargeable.

Eventually, the growing popularity of mobile devices led companies to develop safe commercial lithium-ion batteries, first popularised by Sony camcorders in the 1990s.

Compared to the older nickel-cadmium versions, lithium-ion batteries were smaller and lighter and retained their charge for much longer, giving rise to mobile phones, laptops and other portable devices.

At the same time, the rise in climate-change awareness and environmental policies boosted demand and investment appeal of sustainable power-generation technologies like wind and solar.

Because these resources are only available at certain times of the day and the year, using wind and solar requires a lot of energy storage capacity, or batteries.

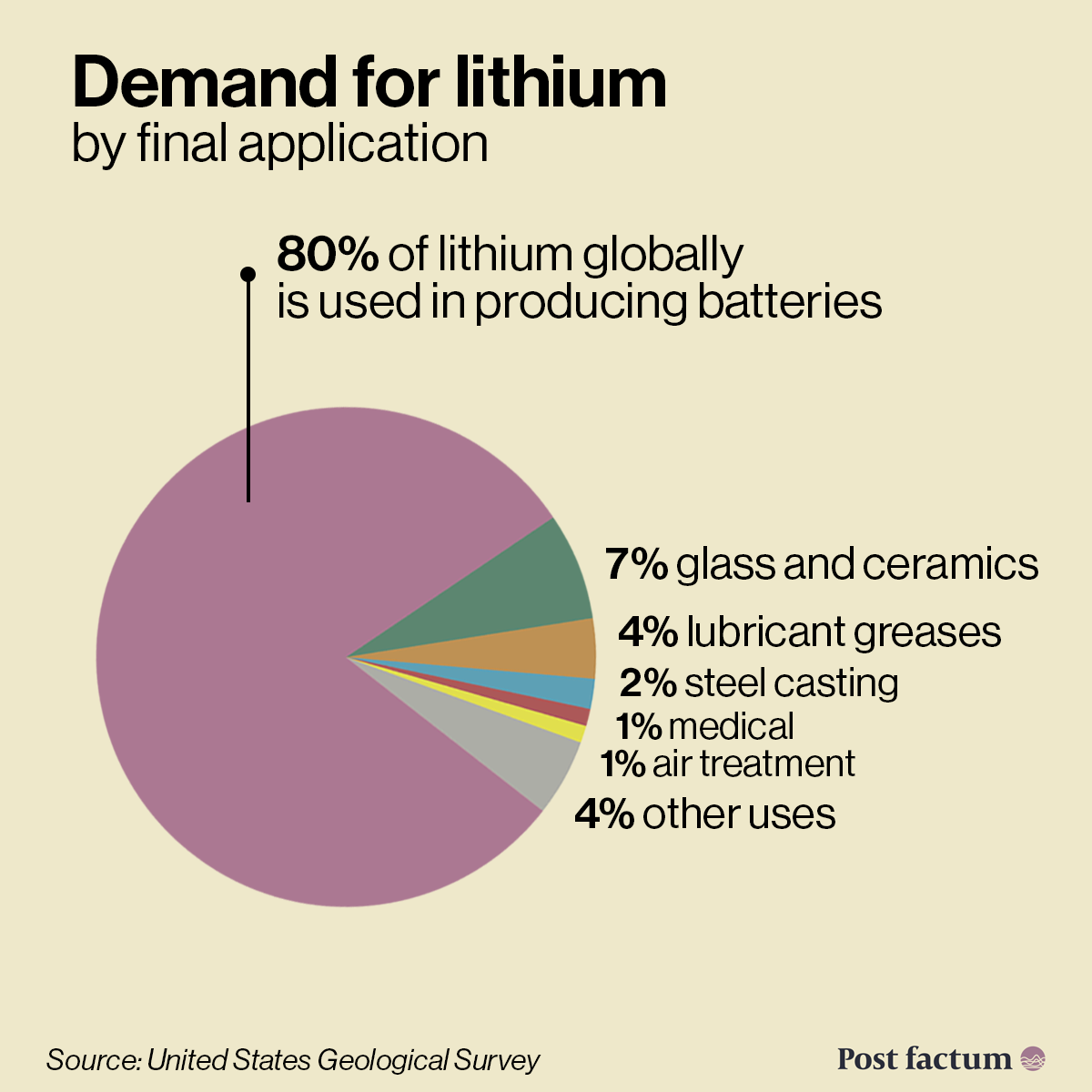

Lithium-ion batteries are currently the best available solution for energy storage, so demand for lithium increased dramatically with growing need for storing electricity.

Most recently, the majority of this demand came from electric vehicles (EV) industry, as car batteries use a large amount of raw lithium compared to mobile devices, and the EV sector has been expanding quickly.

Lithium extraction and processing have been criticised for their negative environmental impact.

The lithium brines have a high salinity and non-lithium salts created during the evaporation are often discarded as waste, which contaminates waterways.

Lithium mining also contributes to water scarcity and carries high greenhouse-gas emissions.

How did the price of lithium change?

Between 2010 and 2023, the global lithium supply grew from 28,100 to 180,000 metric tons.

This was barely keeping up with the global demand which tripled between 2017 and 2022 alone, while the value of the global market for lithium grew by a factor of 6.7.

The price of lithium carbonate steadily grew to around $20,000 per tonne until late 2021, when it shot up to $35,000 within months and in 2022 breached $70,000 per tonne.

The COVID-19 pandemic presented a challenge to lithium supply, due to the fact that most of the world’s lithium is processed in China and the country’s pandemic restrictions stalled the supply chain.

At the time, projections warned of an upcoming period of lithium scarcity where demand could not be fulfilled by the lagging supply.

Some companies, desperate to avoid losses, signed exclusive long-term lithium contracts, locking up a large share of supply for themselves.

This resulted in an actual shortage and caused a sharp rise in the price of the remaining lithium.

High prices motivated investment in lithium exploration, extraction and processing, so by the end of 2022 the market was flooded with lithium as supply problems eased.

In 2023, lithium prices dropped by 80% throughout the year.

The demand for EVs also slowed in 2023, contributing to the drop in lithium price.

In China, during the boom of lithium prices, a lot of investment was made into expanding mining from lepidolite – a mineral which is the most common form of lithium, abundant locally, but more expensive to mine from.

This mining made sense at high prices but became a financial drain as they stabilised around $15,000 per tonne in 2024.

How do countries pursue self-sufficiency?

It is becoming increasingly obvious that global need for energy and energy storage is only going to rise, especially as more of it is converted to electricity.

Lithium market is concentrated – 3 largest producers control 80% of supply (Australia, Chile and China), while 3 largest refiners (China, Chile and Argentina) control 99% of all processing.

International Energy Agency rates lithium’s supply and geopolitical risks at 4 out of 5.

Supply of lithium is sensitive to geopolitical volatility and could be weaponised against importers in a conflict.

Because of these risks, as well as critical importance of lithium to manufacturing and energy systems, countries are looking to secure their supply.

Ideally, major geopolitical players want to extract lithium, process it and manufacture batteries themselves, or at least rely only on friendly states.

China’s secure grip over the global supply chain of lithium is largely a result of their timely and dedicated policy to pursue it in the last 10-15 years.

Investment in domestic refining, processing and battery manufacturing has built up an overwhelming industrial capacity in these areas, but it does rely on a steady supply of raw lithium.

Apart from extracting lithium locally, Chinese companies actively pursue global partnerships with suppliers, often purchasing equity in these producing firms.

Between 2018 and 2021, Chinese firms invested in lithium assets globally double the amount invested by the US, Australia and Canada combined.

In 2018, Chinese corporation Tianqi Lithium purchased 24% of the world’s largest lithium extracting company, Chilean SQM for $4.1 billion.

This has likely allowed Tianqi access to SQM’s exclusive know-how, as well as prospects of influencing its business decisions or even acquiring a controlling share, and the negotiations between SQM shareholders remained tense since.

Chilean government is currently pursuing tighter control over the lithium industry.

China also increased cooperation with and imports from upcoming African suppliers like Zimbabwe and Mali who put its investment to good use.

In many countries, lithium mining turned into a legal and political battleground with fierce fighting for influence over major producing companies and infrastructure, as more nations step in to closely monitor foreign investment deals.

The US and Europe have also been pushing for greater self-sufficiency in lithium.

The world’s largest producer, Australia, is a NATO member, reducing supply risks for its allies.

Dependence in processing and battery manufacturing remains an issue and was recognised a national security threat by the US military.

A 2023 estimate by Bloomberg suggests the US would need an $82 billion investment to achieve battery supply chain self-sufficiency, while Europe would require $98 billion.

In Europe especially, the focus is often on recycling lithium-ion batteries to reduce imports, but mining projects also exist, such as in Portugal and Germany.

The future of lithium

A growing new part of the global lithium economy is the lithium-ion battery recycling industry.

Currently, recycling efficiency varies greatly across the world. In Europe, which is at the forefront of lithium recycling and accounts for about 20% of global battery market, at least 50% of lithium must be recovered from all recycled batteries.

Large batteries are completely banned from landfills and must be recycled, while collection rate for smaller batteries are also high. EU aims for an overall efficiency in lithium recycling of 65% by 2026.

New recycling techniques are being tested by companies globally, as a steep rise in recycling efficiency may eliminate the need to mine lithium.

Researchers are also looking for improvements in the efficiency of lithium extraction.

Direct lithium extraction is the name for a set of advanced techniques that make it possible to derive lithium from liquids without having to evaporate them.

If direct lithium extraction can be scaled, this innovation can enable the extraction of lithium from sources that today are too dilute to use.

Some companies are experimenting with alternative battery designs, which could potentially be cheap, sustainable and use less critical minerals, such as sodium-ion batteries.

Currently, those batteries have lower energy density and sustain fewer charge-recharge cycles compared to lithium-ion batteries, but advances in battery composition can one day help mitigate the global dependence on lithium.

Mining projects take many years to start production, so the supply will be slow to adapt to any dramatic shifts in demand for critical minerals.

However, there is currently little indication that the need for lithium would drop sharply.

Current supply combined with projects that are already planned would only satisfy 50-60% of global supply by 2035, suggesting there is still room for investment projects.

The recent drop in the price of lithium was largely a result of an oversupply and may not be indicative of future price trend, as the demand for batteries continues to expand.

Concentration of the market is likely to remain high, as almost 50% of refining projects planned for 2023-2030 are located in China.

African suppliers, especially Zimbabwe, are projected to win over a higher share of global lithium mining by 2030.

Thank you for reading! Please, share this report with another curious mind.

Resources and further reading: